December 1, 2024

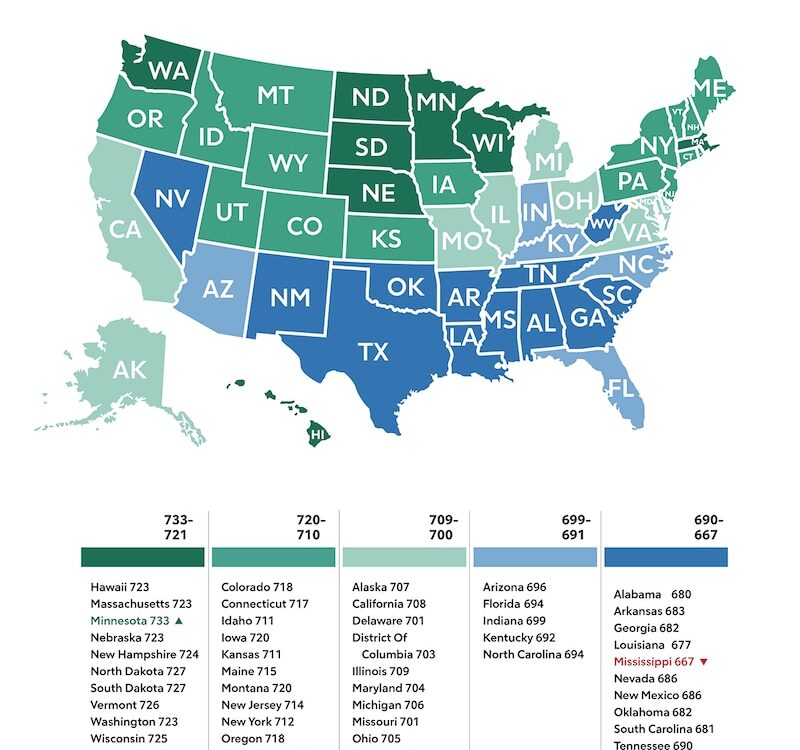

Credit scores are more than just numbers—they represent a person’s financial health and responsibility. These scores impact various aspects of life, from getting approved for a loan to securing the best interest rates. Interestingly, credit scores vary across states due to differences in income, cost of living, and financial habits. […]